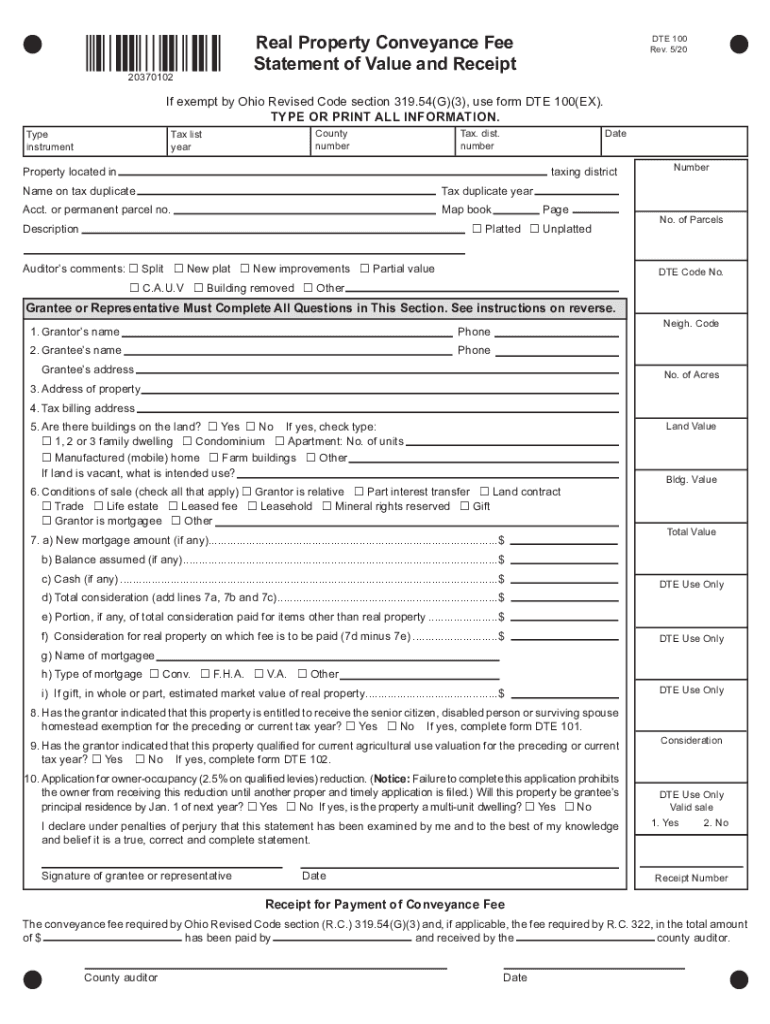

The liability for the RETT is imposed on the grantor, but if the grantor fails to pay or is exempt from the tax, the tax is levied on the grantee. Generally, the RETT is imposed on all conveyances of real property or interests of real property when the consideration exceeds $500. The New Budget Bill contains a major change to the liability provisions for New York State's real estate transfer tax (RETT). File a complaint form with their help, which will allow you to bring a case to decide the ownership title of the property.On April 19, Governor Andrew Cuomo signed into law the New York Budget Bill for the 2021-2022 state fiscal year (Senate Bill S2509C) (the New Budget Bill). When the owner of the land tries to eject you, hire a lawyer to represent you in court. Adverse possession also requires you to openly occupy the land, so take photos of the changes you've made and get witnesses to testify that they've seen you living there. However, remember that the regulations vary from state to state, so you'll need to check your local laws. You should also make sure that you're occupying the land continuously for an extended period of time, like 10 or 20 years. For example, you may put up a small building on the land or make drainage improvements. To acquire property this way, you must take possession of the land you’ve occupied, which means making improvements to it. The court clerk will give you a case number when you file your petition.Īdverse possession is when you gain ownership of property by occupying it for an extended period of time. On the right-hand side of the page, you should type “Case No.” and then leave a blank line. Also add “John Does 1-100” in case there are people you haven’t identified who own an interest in the land. Space down three lines below the “v” and insert the name of the owner, justified with the left-hand margin.

The name of the owner of the property.The letter “v” a couple of lines below your name.You are the “plaintiff.” You should type your name like this “Michael Jones, plaintiff.” Put this information beneath the court name, justified with the left-hand margin. Also type the court name in bold, all caps. Insert this at the top of the page, centered between the left- and right-hand margins. The caption should contain the following information: X Research source It contains standard information and will not change throughout the lawsuit. The caption appears at the top of the page. X Research source X Research source Stop in and check with your county tax assessor.Ĭreate a caption. In Florida, for example, you would file a “Return of Real Property in Attempt to Establish Adverse Possession Without Color of Title.” You can then pay the taxes. However, if you don’t have any deed, then in some counties you can go to the tax assessor’s office and file a document asserting your attempt to establish adverse possession.You will be sent the tax bill if you took possession with what you thought was a valid deed, and you recorded the deed with the Recorder of Deeds office.For example, in North Dakota, you must continuously occupy the land for 20 years unless you paid property taxes, in which case you must occupy it for only 10 continuous years.Make sure to hang onto copies of your tax assessment and canceled checks or other proof that shows you paid taxes on the property. In other states, the amount of time you must continuously occupy the land will be reduced if you pay taxes. In some states, you must actually pay taxes on the land in order to qualify for adverse possession.

0 kommentar(er)

0 kommentar(er)